Who We Are

Experienced, Stable and Structured for Continued Investment Excellence

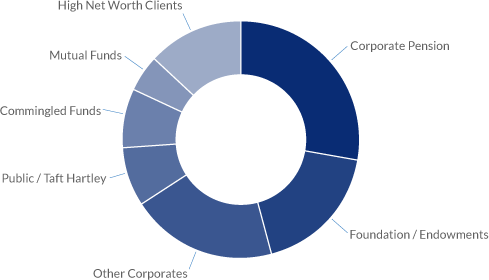

DSM Capital Partners actively manages growth stock investment portfolios for a wide range of clients, including pension plans, foundations and endowments, other institutions, and individual investors. The firm follows a disciplined investment process designed to identify quality companies presenting compelling long-term revenue and earnings growth and selling at prices that offer the potential for attractive returns.

DSM was founded in 2001 by Daniel Strickberger and Stephen Memishian. Today the firm remains 100% owned by current employees and founding partners. The portfolio management, research, client service and business management teams are staffed with seasoned and capable professionals solely focused on the achievement of our clients’ financial objectives.

Headquartered in Palm Beach Gardens, Florida, DSM manages over $6 billion across domestic, international, global and emerging market equities offered through a variety of investment strategies and vehicles.

DSM offers investment strategies in US Large Cap Growth, Global Growth, Global Focus Growth, Dividend Growth and Runway Strategy.

Onshore Investing

DSM offers separately managed accounts for US Large Cap Growth, Global Growth, Global Focus Growth, aDividend Growth and Runway Strategy portfolios.

DSM also serves as a Sub-Advisor to a US Mutual Fund for the US Large Cap Growth. Additionally, DSM offers a Commingled Investment Fund (CIF) and a Delaware Statutory Trust (DST).

Offshore Investing

DSM offers both Global Growth and US Large Cap Growth in its Luxembourg SICAVas well as Global Growth in its Australian Unit Trust.