US Large Cap Growth

The DSM US Large Cap Growth strategy seeks long-term capital appreciation through investments in the stocks of quality US large cap companies exhibiting strong growth characteristics and share prices that represent attractive returns.

The strategy generally invests in 25 to 35 companies with market capitalizations typically in excess of $10 billion. Generally, up to 20% of the portfolio may be invested in non-US companiesa. The strategy uses no leverage, futures, options or derivatives.

The US Large Cap Growth strategy is available in:

a Companies domiciled outside of the United States whose stocks primarily trade on US exchanges, including over-the-counter markets, are generally considered to be domestic securities.

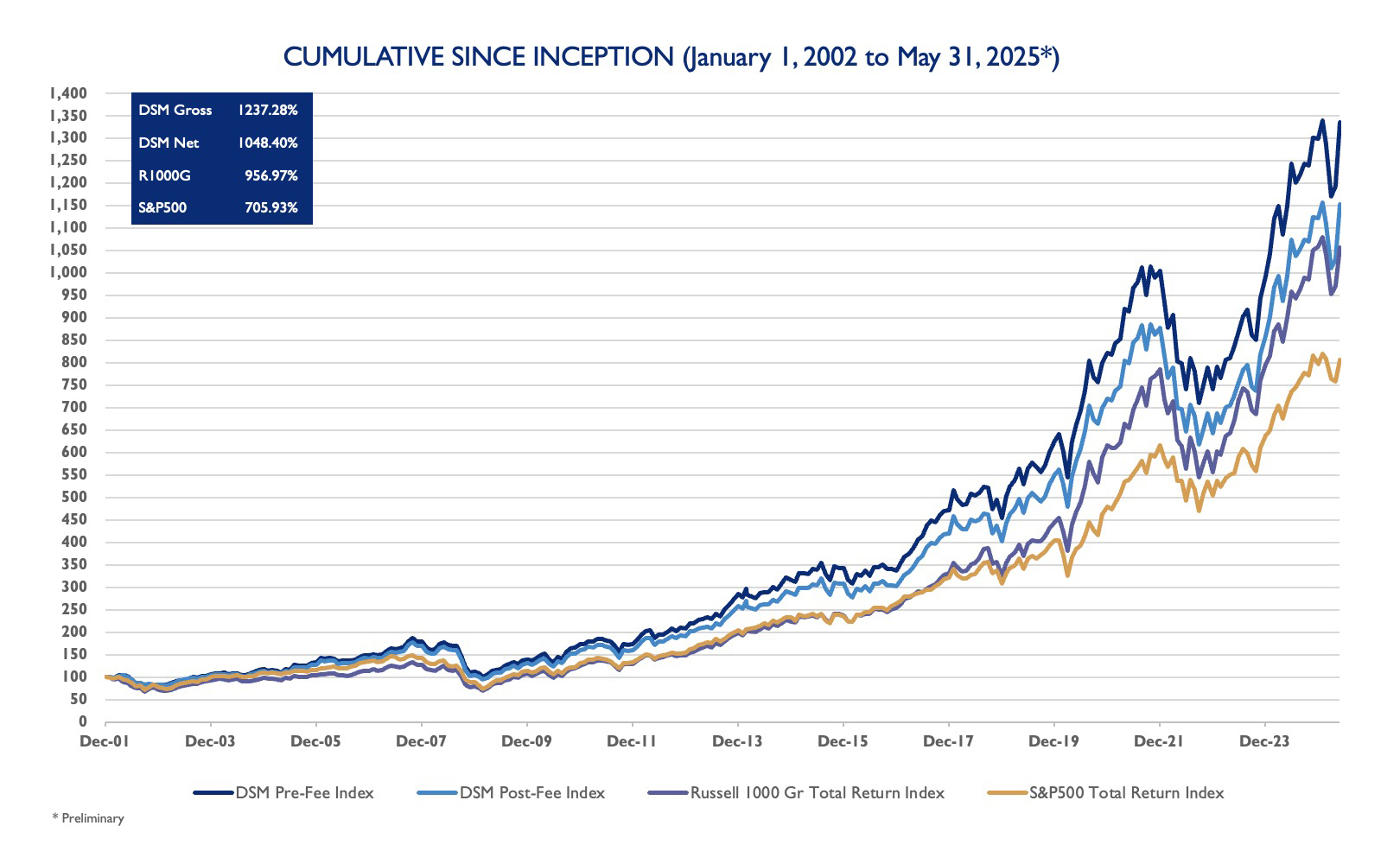

- Chart

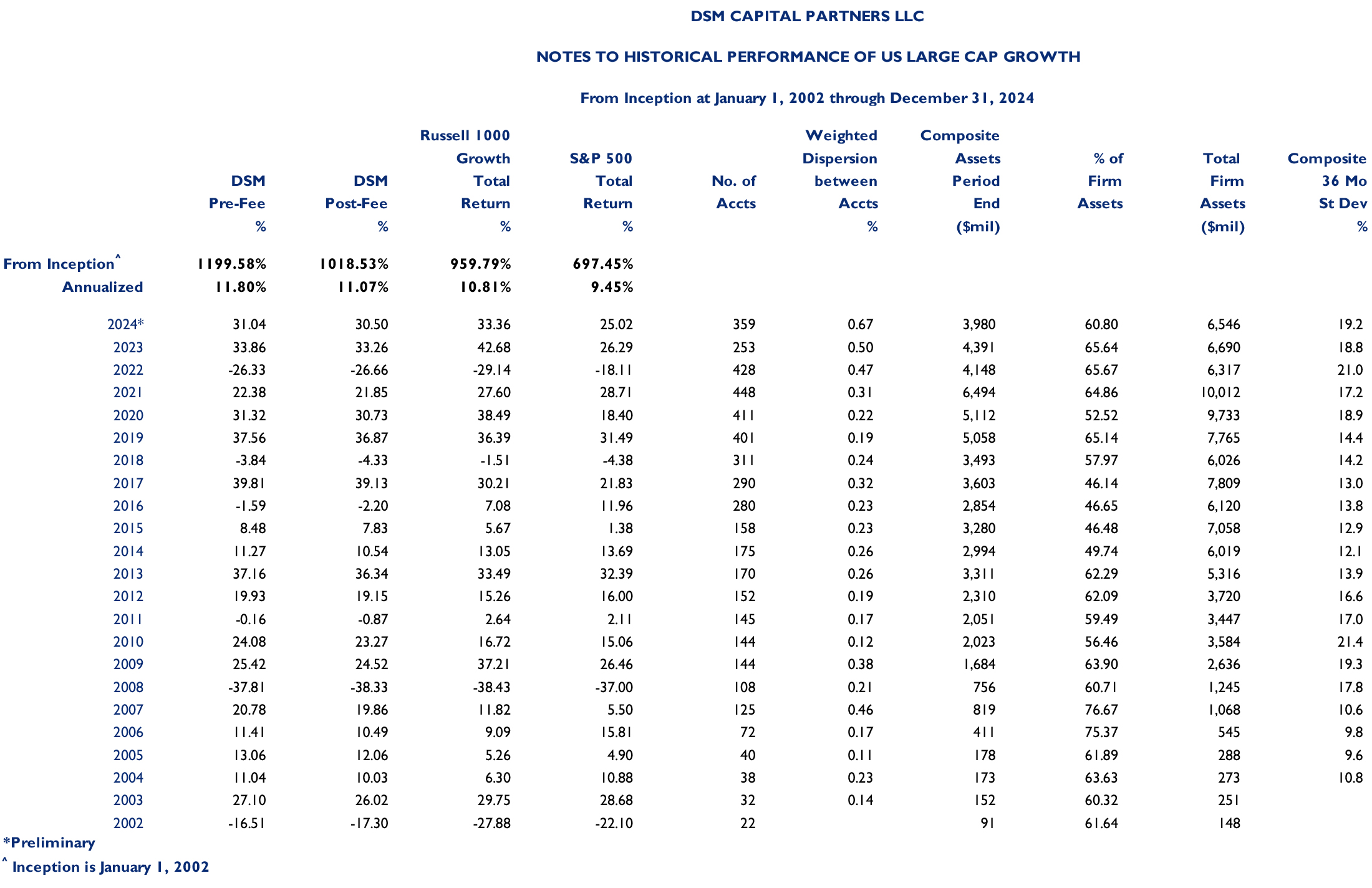

- Tables

- Notes

Periods ending May 31, 2025

| May* | YTD* | Trail 12M* | 3 Years* | 5 Years* | 10 Years* | Cumulative Since Inception*^ | Annualized Since Inception*^ | |

|---|---|---|---|---|---|---|---|---|

| Pre-Fee | 11.96% | 2.90% | 16.56% | 18.71% | 15.09% | 14.66% | 1237.28% | 11.71% |

| Post-Fee | 11.96% | 2.67% | 16.05% | 18.20% | 14.59% | 14.10% | 1048.40% | 10.99% |

| R1000G | 8.85% | -0.27% | 17.62% | 19.85% | 17.69% | 16.08% | 956.97% | 10.59% |

| S&P 500 | 6.29% | 1.06% | 13.52% | 14.41% | 15.94% | 12.86% | 705.93% | 9.32% |

Annual Periods ending May 31, 2025

| DSM Pre-Fee | DSM Post-Fee | Russell 1000 Growth Total Return | S&P 500 Total Return | |

|---|---|---|---|---|

| Quarterly | ||||

| First Qtr* | -9.82% | -9.91% | -9.97% | -4.27% |

| Yearly | ||||

| 2025* | 2.90% | 2.67% | -0.27% | 1.06% |

| 2024 | 31.04% | 30.50% | 33.36% | 25.02% |

| 2023 | 33.86% | 33.26% | 42.68% | 26.29% |

| 2022 | -26.33% | -26.66% | -29.14% | -18.11% |

| 2021 | 22.38% | 21.85% | 27.60% | 28.71% |

| 2020 | 31.32% | 30.73% | 38.49% | 18.40% |

| 2019 | 37.56% | 36.87% | 36.39% | 31.49% |

| 2018 | -3.84% | -4.33% | -1.51% | -4.38% |

| 2017 | 39.81% | 39.13% | 30.21% | 21.83% |

| 2016 | -1.59% | -2.20% | 7.07% | 11.96% |

| 2015 | 8.48% | 7.83% | 5.67% | 1.38% |

| 2014 | 11.27% | 10.54% | 13.05% | 13.69% |

| 2013 | 37.15% | 36.28% | 33.48% | 32.39% |

| 2012 | 19.93% | 19.16% | 15.26% | 16.00% |

| 2011 | -0.19% | -0.88% | 2.64% | 2.11% |

| 2010 | 24.08% | 23.27% | 16.71% | 15.06% |

| 2009 | 25.42% | 24.52% | 37.21% | 26.46% |

| 2008 | -37.81% | -38.33% | -38.44% | -37.00% |

| 2007 | 20.78% | 19.86% | 11.81% | 5.50% |

| 2006 | 11.41% | 10.49% | 9.09% | 15.81% |

| 2005 | 13.06% | 12.06% | 5.26% | 4.90% |

| 2004 | 11.04% | 10.03% | 6.30% | 10.88% |

| 2003 | 27.10% | 26.02% | 29.75% | 28.68% |

| 2002 | -16.51% | -17.30% | -27.88% | -22.10% |

GENERAL PERFORMANCE COMPOSITE FOOTNOTES

- Past performance is no guarantee of future results and individual accounts and results will vary. Materially different market or economic conditions could result in markedly different performance, including the possibility of loss. The content presented is for informational purposes only. It is not intended to reflect a current or past recommendation, investment, legal, tax or accounting advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. Except as otherwise specified, any companies, sectors, securities and/or markets discussed are solely for illustrative purposes regarding economic trends and conditions or investment process and may or may not be held by DSM Capital Partners LLC (“DSM”) or other investment vehicles or accounts managed by DSM. Investing entails risks, including possible loss of principal. There are also special risk considerations associated with international and global investing (especially emerging markets), small and mid-capitalization companies, or other growth and/or concentrated investment strategies.

- DSM, located in Palm Beach Gardens, Florida, is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended, managing separate accounts, pooled investment vehicles and wrap accounts for both institutional and high net worth investors.

- DSM primarily manages equities in a model portfolio method and therefore presents a single composite return for managed accounts of each strategy offered. In general, the US Large Cap Growth strategy will invest in domestic equity securities of large capitalization companies. Domestic equity securities, as determined by DSM in its discretion, include, but are not limited to, common stocks, preferred stocks, securities convertible into common stocks, rights and warrants. In addition, shares of foreign domiciled companies that primarily trade on a U.S. exchange are typically considered by DSM to be domestic equity securities. As determined by DSM, companies that issue domestic equity securities may be domiciled and/or headquartered anywhere in the world. The US Large Cap Growth strategy may invest up to 20% of its assets in equity securities of foreign issuers. Up until March 31, 2017, the US Large Cap Growth strategy had historically invested approximately 15% of its assets in foreign equity securities. A large capitalization company is one that has a market capitalization of U.S. $10 billion or more at the time of purchase. The US Large Cap Growth strategy may invest in equity securities of companies that have a market capitalization below U.S. $10 billion at the time of purchase. The US Large Cap Growth composite has historically held certain mid-cap stocks. DSM’s classification of market cap ranges may differ materially from other large cap growth managers. The US Large Cap Growth strategy generally will contain 25 to 35 equity securities.

- DSM claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. DSM has been independently verified for the periods January 2002 – December 31, 2024. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The US Large Cap Growth Composite has had a performance examination for the periods January 2002 to December 31, 2024. The verification and performance examination reports are available upon request. Benchmark returns are not covered by the report of independent verifiers.

- DSM’s performance composite includes all fee-paying US Large Cap Growth managed equity accounts, that allow DSM to buy and sell securities with discretion, with the exception of accounts that have individual security positions with absolute variances of 100 bps or more from target (including cash) that, taken together, equal or exceed 12% of the equity value of the account at the beginning of a given calendar month. The composite was created on January 1, 2002. Beginning July 1, 2016, except as noted above, certain other accounts (i.e. accounts below the composite minimums and accounts with significant cash flows) are no longer removed from the composite. Prior to July 1, 2016, DSM removed these types of accounts from the composite. This change caused a significant increase in the number of accounts to be included in the composite. A complete list of composite descriptions, a list of pooled fund descriptions for limited distribution pooled funds, and a list of broad distribution pooled funds are available upon request, as well as policies for valuing portfolios investments, calculating performance, and preparing GIPS Reports may be requested from Russell Katz, DSM Capital Partners, 7111 Fairway Drive, Suite 350, Palm Beach Gardens, FL 33418. Phone: 561-618-4000; email: [email protected].

- DSM first offered the US Large Cap Growth strategy to clients during December 2001. Only one client account was fully invested by January 1, 2002. That account comprised the performance composite for January 2002. There are various types of client accounts presently in the composite.

- Performance is presented in US Dollars. Results are time-weighted and asset-weighted based on beginning-of-period asset values. Valuation is on a trade-date basis. Results include the reinvestment of dividends and other earnings. Dividends are realized on an accrual basis; cash equivalent dividends are realized on a cash basis. Composite returns are net of withholding taxes on foreign dividends. As of March 2017, reclaimed withholding taxes are recognized as income when received. Pre-fee results include the effect of commissions; post-fee results include the effect of commissions and management fees. Custody charges, where applicable, are not deducted from gross and net-of-fee performance. The 36-month annualized standard deviation measures the variability of the composite gross of fees and the benchmark returns over the preceding 36-month period. The 36-month standard deviation is not shown for periods comprising fewer than 36 monthly returns. Dispersion between accounts is the asset-weighted standard deviation of gross returns for active accounts with DSM for the entirety of a given year. Dispersion is only reported for years having five or more such accounts. Additional information regarding policies for calculating and reporting returns is available upon request.

- DSM’s management fee for the US Large Cap Growth strategy is generally 1.0% per annum on the first $5 million of assets, 0.75% on the next $15 million, 0.625% on the next $80 million, and 0.50% on amounts thereafter, or a “flat” fee of 0.45% for amounts in excess of $200 million. DSM’s management fees are fully detailed in Part 2A of its Form ADV. The management fee is generally charged quarterly in arrears, but also may be charged in advance. Certain accounts, if any, in the composite may have different fee structures (including performance fees) and certain accounts may involve non-fee expenses not included above. The composite for the DSM Large Cap Growth strategy includes a limited distributed pooled fund, the DSM All World Growth Trust – Large Cap Growth Portfolio that has a management fee of 0.70% and an expense ratio of 0.15%. From inception through June 30, 2016 DSM calculated monthly post-fee performance by applying one-third of the quarterly management fee to each month of a quarter. Because fee billings are generally calculated based on beginning-of-quarter market values, monthly post-fee returns based on beginning-of-month market values may compound to more or less than quarterly post-fee returns. As of July 1, 2016, DSM calculates post-fee returns by deducting the entire quarterly management fee in the first month of the quarter, with no fee deduction in the second and third month of the quarter. As of January 1, 2017, for accounts with performance fees, the variable fee calculated at the end of a given year, to be paid by a client early in the next year, is applied to mid-December of the prior year.

- The Russell 1000 Growth Total Return Index includes dividends reinvested in the Russell 1000 Growth Index as reported by the Russell Company. The Russell 1000 Growth Index is a capitalization weighted index containing securities with growth certain characteristics. DSM uses the Russell 1000 Growth Index as a benchmark because its average market capitalization is similar to that of the U.S. Large Cap Growth composite, and it is an industry standard. S&P 500 Total Return includes dividends reinvested in the S&P 500 index, as reported by Standard & Poor’s. Characteristics of any benchmark may differ materially from accounts managed by DSM. The volatility of a benchmark may be materially different from the individual performance attained by a specific client investing within this strategy, and the holdings of the accounts contained within the composite may differ significantly from the securities that comprise the benchmark. Indices are not assessed a management fee and investors cannot directly invest in an index.

- Leveraged accounts, if any, in the composite involve non-discretionary leverage only. In such cases, per GIPS recommendations, the effect of leverage is removed by treating borrowing as a cash flow and adding back margin interest.

- There have been no material changes in the persons responsible for the investment management of the US Large Cap Growth strategy since its inception.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the contained herein.

Revised: 06/25/2025